What role will crypto play during the recession?

First of all, this is not a financial advice. DYOR.

I would like to begin this article by talking about the important variables that have brought us to this point. When we talk about recession, we need to consider several geopolitical, social, and economic aspects.

We can mention some of them here:

Significant increase in consumption;

Debt bubble;

Massive money printing;

Low-interest rates, and delay in interest rate correction by the FED;

2008 crisis;

Geopolitical issues.

Among this scenario of high inflation levels, interest rates, and economies collapsing, it is essential to consider what role crypto will play in the following years.

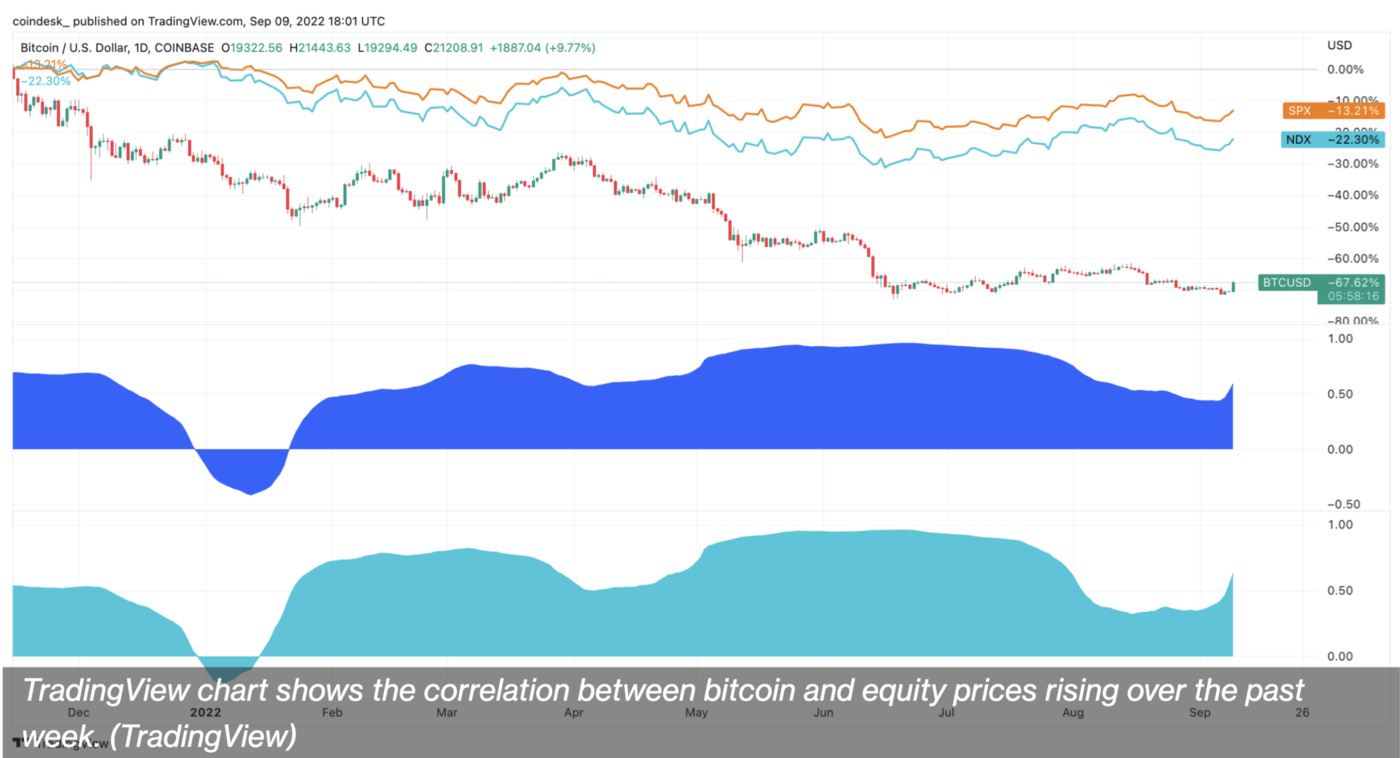

In theory, Bitcoin was created to be a hedge. The 2008 crisis emphasized it as an alternative to the actual financial system. However, we increasingly see Bitcoin and the crypto space following the stock exchanges, especially Nasdaq and S&P500. Among the main factors that support this correlation are:

Institutional investors in Bitcoin;

Monetary policies;

Inflation;

International relations.

It is crucial to remember that 14 years since its creation is a minuscule period to assume any stigma about Bitcoin or cryptos. If we look back in history, it is impossible to analyze facts considering a time frame of only 14 years.

This will be the first time crypto assets have experienced a stress testing as a recession. While we don’t know if Bitcoin and the crypto ecosystem, in general, will follow the swings of stocks or if, during a chaotic scenario, they will finally untick from that dependence, we can analyze what big names in economics are saying and what their opinions are.

For Warren Buffett, cryptocurrencies are assets that do not produce any income. Price increases because people who bought them are speculating more people to adopt crypto. In most of his interviews, I see him mentioning only a small part of the crypto ecosystem, the Bitcoin.

However, today, besides being a hedge, crypto also has Smart Contracts platforms that allow developers to build their applications on Web 3, and this undeniably has value and generates income.

Warren Buffett opinion about crypto

On the other side, we have Robert Kiyosaki — Rich dad, poor dad — a big name who has spoken numerous times about his crypto investments and why he believes in the technology.

For those interested, I suggest this video:

Robert, unlike Buffett, seems to see the whole cryptocurrency picture. As mentioned earlier, although Bitcoin was created to store value, as the ecosystem has developed, other essential players have emerged. The Smart Contracts platforms that allow us to replicate the economy in a more decentralized, transparent, and fully digital way are a significant advance and generate income like any other operational business.

Perhaps seeing this change is not easy, just as it was not when the Internet was launched. “Why would we want e-mail if there is already mail that works well? Whether you want to admit it or not, crypto is already the mainstream for many people and has evolved to such an extent that it has caught the attention of governments and taxing bodies.

Today, we see numerous movements for taxing crypto assets. Everyone wants their piece of the pie, don’t they? It is interesting to look at the fact that they are trying to discredit crypto at the same time as they are trying to create CBDCs. Governments around the world have been striving to develop their central bank currencies.

The question that surrounds me is how this integration will happen. Have they surrendered to the ideals of decentralization and equality that the blockchain brings, or are they planning something else?

How crypto will perform in the recession is unknown. Still, how the ecosystem has been structured is undeniably applicable, scalable, and very profitable, essential factors for any asset.